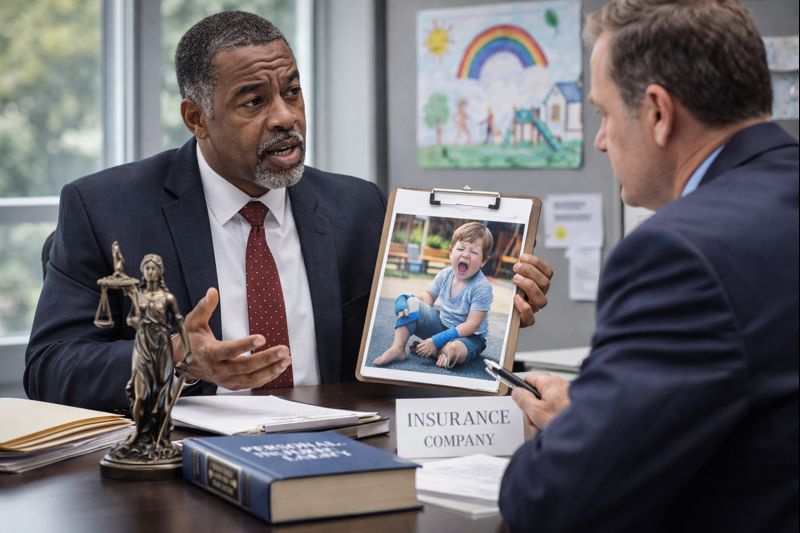

When a child gets hurt at a daycare, camp, church program, or youth sports event, families often focus on the injury and the safety failure. Insurance shapes what happens next.

Coverage can determine who pays, how much money sits on the table, and how quickly a claim moves. “Coverage chess” describes the back-and-forth over policies, endorsements, and deadlines that can quietly drive settlement value.

This post explains what those fights look like in Georgia and what practical steps help protect a claim early.

Coverage Disputes in Youth Injury Claims

Most youth organizations carry a general liability policy, but the coverage picture rarely stops there. A contract between the organization and a vendor, such as the transportation company, security, facility owner, or sports operator, may trigger an additional insured endorsement. That endorsement adds another party to someone else’s policy for certain claims, and wording differences can change the scope fast.

You may also see “no-fault” medical payments coverage under a liability policy, which can reimburse medical expenses without proving fault. Separately, some organizations buy volunteer or participant accident coverage that pays limited benefits after an injury. Those policies can help with immediate costs, but they do not replace liability coverage and do not answer the negligence question.

Notice Requirements and Timing Under Georgia Law

Insurance companies pay close attention to timing, sometimes more than families expect. Most policies ask for quick notice after an injury and another heads-up once a lawsuit appears. If the policy says timely notice is a condition of coverage, Georgia courts have enforced that language, which means a delay can change the entire coverage picture.

There is also a separate Georgia rule for motor vehicle liability policies that deals with an insured’s duty to cooperate and report the claim, which is relevant when a child is hurt in a van, bus, or other transport tied to a youth program. These timing rules often become bargaining chips. A late notice issue does not erase what happened to the child, but it can limit how much insurance sits behind the claim, and that shift can influence settlement discussions.

Act Before Insurance Defenses Take Hold

If insurance questions already shape how the organization responds to your child’s injury, early guidance helps. Our team at The Williams Litigation Group can review the policy landscape, assess notice problems, and explain what steps to take next. Call 1-866-214-7036 or reach us through our contact form.