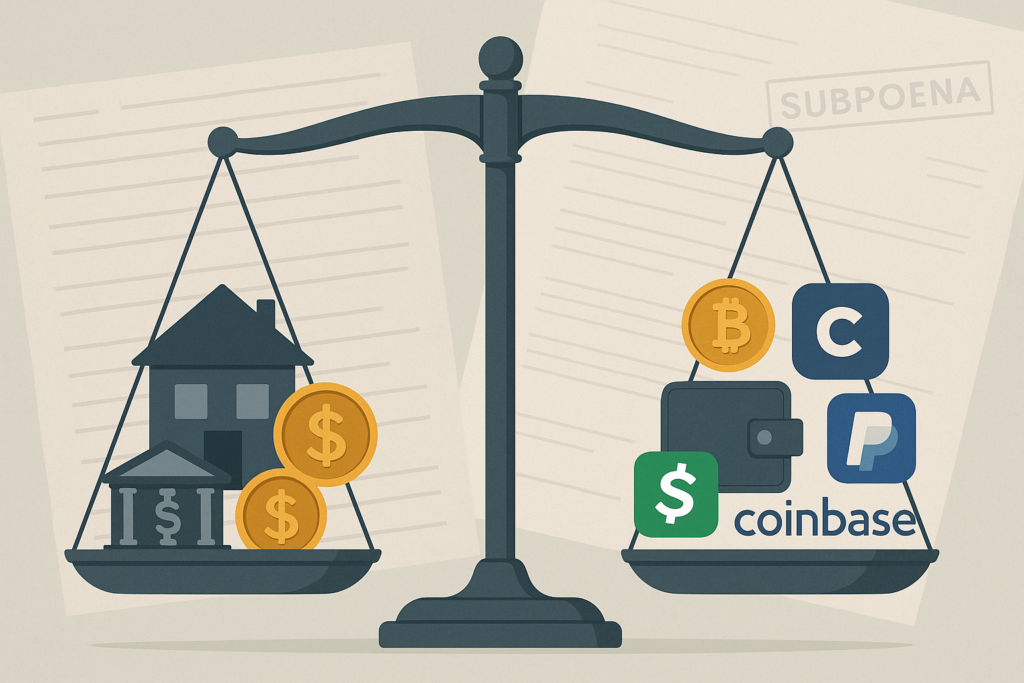

Most people think estate assets are limited to bank accounts, real estate, and maybe some stocks. However, these days, digital assets, such as cryptocurrency and money held in fintech apps, can hold real value. In some estates, these assets are often quietly left off the books.

If you’re a surviving spouse or child in Georgia, those hidden assets could directly affect your year’s support award.

Year’s Support Comes First, But Only If the Assets Are Counted

In Georgia, surviving spouses and minor children can file for year’s support instead of taking under a will. This gives you a court-ordered share of the estate to support yourself for 12 months. By law, it ranks above most other estate debts.

However, that protection only works if the estate is reported fully. If the personal representative skips over crypto wallets, Cash App balances, or hidden brokerage transfers, the court may never see them. Therefore, your award could end up far smaller than it should be.

Subpoenaing FinTechs and Exchanges

Georgia law lets attorneys subpoena platforms like Coinbase, PayPal, or Cash App to find out what was there. Under O.C.G.A. § 24-13-21, attorneys can request account histories, wallet addresses, linked bank details, and login info. For out-of-state companies, Georgia’s version of the Uniform Interstate Depositions and Discovery Act (UIDDA) lets attorneys domesticate subpoenas quickly; no separate lawsuit required.

If the records show that digital assets were moved before death or simply left off the inventory, attorneys can take legal action to bring them back in.

Tracing Crypto and Asking the Court to Step In

If an account or crypto wallet is linked to the decedent, forensic tools can help trace its movement. When assets were shifted improperly through fraud, coercion, or concealment, Georgia courts may impose a constructive trust or reverse a voidable transfer. These legal remedies pull the assets back into the estate.

We Help Families Recover What Was Left Out

At The Williams Litigation Group, we handle estate cases involving hidden assets, digital currency, and fintech records. If you’re concerned that a loved one’s estate isn’t showing the full picture, we can help you take the right legal steps before the deadline runs out. Call us at 866-214-7036 to start a conversation.